Posts Tagged ‘£10’

Are polymer banknotes indestructible? Millions of damaged notes forced to be replaced…

Do you remember how strange it felt to hold your first polymer £5 note when they were released back in 2016?

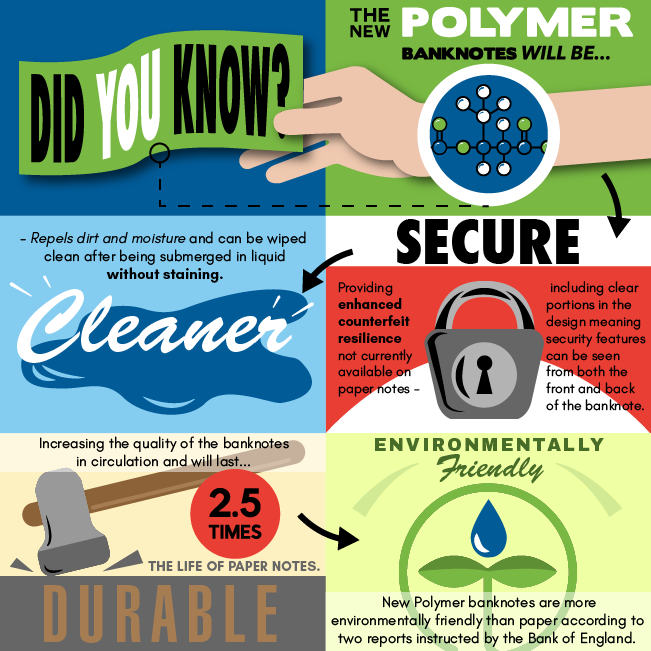

Billed as the most durable banknotes yet, the new polymer notes replaced the old paper versions with a thin and flexible plastic material which was said to be cleaner, safer and stronger.

And whilst it’s claimed they should last 2.5 times the lifespan of paper notes, it seems they might not be as durable as once thought…

It’s now been four years since the £5 notes were released, three years since the £10 notes were released and we’re just over a month away from the release of the new polymer £20 note.

Whilst we’re all really excited for the upcoming release of the new £20 note featuring JMW Turner, the question remains as to how durable this note will really be.

50 million damaged polymer banknotes replaced

Recent figures suggest that almost 50 million polymer £5 and £10 notes have been forced to be replaced due to the wear and tear sustained since they were released into circulation.

The Bank of England have said that the damage was mainly caused by “folds, tears, holes and foil wear”.

Figures from the Press Association news agency, say that roughly 20 million polymer £5 notes and around 26 million £10 notes have been swapped so far due to damage.

However, the Bank has never said the new notes are indestructible, instead claiming that they should last 2.5 times longer than paper notes, which were lasting an average of just two years in circulation.

The number of polymer banknotes being replaced only represents a small percentage of the total number which are circulating and the Bank suggests that this is in line with their expectations.

“While we expect the polymer notes to have a longer life, it is too early in the note’s lifecycle to yet understand the rate of replacement of polymer notes,” they said.

“The use of polymer means it can better withstand being repeatedly folded into wallets or scrunched up inside pockets, and can also survive a spin in the washing machine.”

In 2015, 21,835 paper banknotes were replaced due to damage from being torn, washed, contaminated, damaged and even chewed and eaten!

The new polymer material is resistant to dirt and moisture which means they will stay in a better condition for longer.

Plus, when a polymer note reaches the end of its life, it will be recycled, meaning the new notes are more environmentally friendly.

New polymer notes to be released

The new £20 note is due to enter circulation on 20 February 2020 and initially the note will be in circulation alongside the existing paper £20 notes.

These will eventually be phased out as we have seen with the paper £5 and £10 notes in the past years.

We are also expecting the new £50 polymer banknote featuring mathematician and second world war codebreaker Alan Turing in 2021.

Are you looking forward to seeing the new polymer notes, and have you experienced any damage to your £5 and £10 polymer notes? Let us know in the comments below!

If you’re interested in coin collecting, our Change Checker web app is completely free to use and allows users to:

– Find and identify the coins in their pocket

– Collect and track the coins they have

– Swap their spare coins with other Change Checkers

Sign up today at: www.changechecker.org/app

£1.5bn worth of old banknotes still in circulation!

It’s been more than two years since the old £5 notes were withdrawn from circulation, and yet 118 million of these notes still have not been returned.

This figure, combined with the 94 million old £10 notes left to be returned (following the withdrawal of the paper note in 2018) means that over £1.5bn worth of outdated banknotes are currently in circulation!

In fact, you might just have one in your pocket/wallet/down the back of the sofa right now!

A spokeswoman from the Bank of England said that the 224 million £5 notes returned was lower than expected, but the 697 million £10 notes returned was in line with their expectations.

It’s possible that these unreturned notes have been lost or damaged, or even held on to by collectors following the introduction of the new polymer notes.

Whilst these paper notes are no longer legal tender, they can still be exchanged at the Bank of England and there is no time limit on this.

I still remember the excitement of the first polymer £5 notes which were introduced in 2016 and whilst they definitely felt alien to begin with, I think it’s fair to say that we have all become accustomed to the polymer design and finding an old £5 or £10 note nowadays is a nostalgic experience.

In fact, many collectors were eager to get hold of some of the more unusual serial numbers for the new Winston Churchill polymer £5 and Jane Austen polymer £10 when they were first released.

And I’m certainly looking forward to seeing the polymer £20 and £50 notes which will be released in coming years.

So do you have any old banknotes lying around? There’s over £1.5bn of them out there somewhere…

If you’re interested in coin collecting, our Change Checker web app is completely free to use and allows users to:

– Find and identify the coins in their pocket

– Collect and track the coins they have

– Swap their spare coins with other Change Checkers

Sign up today at: www.changechecker.org/app

Northern Ireland’s First Trust Bank to stop issuing their own banknotes

First Trust Bank, one of four main banks in Northern Ireland, will become the first Northern Ireland-based bank to end the practice of printing its own-denomination banknotes. The bank revealed it will scrap its own banknotes next year and switch to dispensing Bank of England notes from its ATM network.

Although the UK has a vast variety of different notes in circulation, The Bank of England is the only bank to issue notes for England and Wales, while there are seven different banks in Scotland and Northern Ireland that currently produce their own notes.

First Trust Bank currently their own banknotes in denominations of £10, £20, £5 and £100. Image Credit: The Irish Times

The decision is thought to be an economic issue and means that all existing First Trust banknotes will not be able to be used for payments from midnight on 30th June 2022. They can however be exchanged for Bank of England banknotes, or other sterling banknotes of equivalent value at Post Offices up until 30th June 2024.

Why do Scotland and Northern Ireland issue their own banknotes?

The UK has a vast variety of different notes in circulation and although those of us living in England and Wales don’t see many, there are three different banks in Scotland and four in Northern Ireland that currently produce their own notes.

In fact the tradition of printing banknotes was considered the norm centuries ago as most of the UK’s banks produced their own banknotes. However over time they weren’t all doing it responsibly and were not able to back the notes up with actual assets. The law changed in the 1840’s in England and Wales so all production of banknotes was moved to The Bank of England bar Scotland who argued for an exception as they were not having the same issues. The Bank Notes Act of 1928 allowed banks in Northern Ireland to produce their own notes.

For people living in Scotland and Northern Ireland, the banknotes are part of the furniture and a part of their cultural identity that usually feature local landmarks and historical figures. These issuing banks have also considered the notes as part of their marketing as customers are seeing the name of their banks in their hands as they spend cash.

Can you spend Scottish and Northern Irish banknotes in England?

Yes. The notes are legal currency and backed with physical assets with the Bank of England so can technically be accepted anywhere in the UK. However, the problems come as shops are not always overly familiar with all the different types of notes and may not be sure on how to check them for counterfeiting so don’t like to accept them.

Is this the beginning of the end for Northern Irish and Scottish banknotes?

The decision is scrap the printing of banknotes at First Trust Bank is thought to be an economic issue and comes as other Northern Ireland banks prepare for the change over to modern Polymer notes in the very near future. The update is needed in order to produce counterfeit resilient notes to protect against forgery and ensure the security of circulating notes. But this costly change could be too much for First Trust handle.

Scotland’s Clydesdale Bank was the first bank in the UK to issue a Polymer note in 2015. Image Credit: RBS

There are also a lot fewer of these notes changing hands and with the increasing use of digital payment methods and mobile technology, it could be the reasoning behind the decision to scrap the notes.

The other three Northern Irish banks are currently in various stages of issuing their own polymer £5, £10 and £20 notes and it is clear that Scotland are completely committed to keeping their own notes as Clydesdale Bank was the first bank in the UK to issue a Polymer note back in 2015.