Posts Tagged ‘cash’

Why you won’t find 2018 dated 1p and 2p coins in your change…

It’s been revealed that no 1p and 2p coins were struck for circulation by The Royal Mint last year.

This marks the first time in decades that no penny coins were struck in a year. In fact, the last time we saw a year with no new 1p coins was way back in 1972! And it’s been 35 years since the last time no new 2p coins were struck for circulation.

The future of the penny

Back in May 2019, the UK Treasury confirmed that 1p and 2p coins will continue to be used “for years to come”. Find out the full story here.

This news emerged following concerns that the 1p and 2p coins would be scrapped after their validity was questioned in the 2018 Spring Statement.

Members of the public were outraged by the idea of the humble penny being scrapped. However it isn’t just sentimental value which has safeguarded the future of the penny.

It’s estimated that around 2.2 people are thought to be reliant on cash to live their daily lives. This includes the elderly, vulnerable people and rural communities who would likely be hit hard if cash availability were to decline.

Card payments are on the rise

Nevertheless, it is clear that card and electronic payments are on the rise and whilst around 500 million 1p and 2p coins are usually issued each year, the fact that none were produced last year goes to show how low the demand for these coins currently is.

We already know that no 20p or £2 coins were struck for circulation in 2017 and it’s also been revealed that no £2 coins were struck for circulation in 2018 either.

A spokesperson from the Treasury said, “We didn’t ask the mint to issue any £2 or 1p/2p coins this past year because there are already enough of these in circulation. Our coins are of the highest quality and the amount we ask the Royal Mint to produce every year depends on demand from banks and Post Offices.”

Commemorative £2 coins

Despite no £2 coins entering circulation since 2016, collector editions of the new commemorative designs have still been produced by The Royal Mint to mark Britain’s most important anniversaries.

Whilst some people are happy to pay a little more to secure the latest coins in superior quality, others are understandably frustrated by the lack of coins entering circulation recently.

To give collectors the chance to own 2019 UK £2 and 50p coins for just face value, this year we launched the Change Checker Face Value Coin Ballot, which you can find out about here.

Spending a penny

It’s thought that around 10.5 billion 1p coins are currently in circulation, but the Treasury estimates that roughly 60% of copper coins are typically only used once before being stashed away or lost.

Despite the lack of 1p and 2p coins being struck for circulation last year, we know that the future of our UK coins is still secure (for now at least), but how often do you find yourself actually spending your 1p and 2p coins?

Let us know in our Facebook poll:

If you’re interested in coin collecting, our Change Checker web app is completely free to use and allows users to:

– Find and identify the coins in their pocket

– Collect and track the coins they have

– Swap their spare coins with other Change Checkers

Sign up today at: www.changechecker.org/app

Why you won’t find any 2017 20p coins in your change…

For those of you collecting date runs, you might have noticed that in 2017 The Royal Mint didn’t strike a single £2 or 20p coin for general circulation.

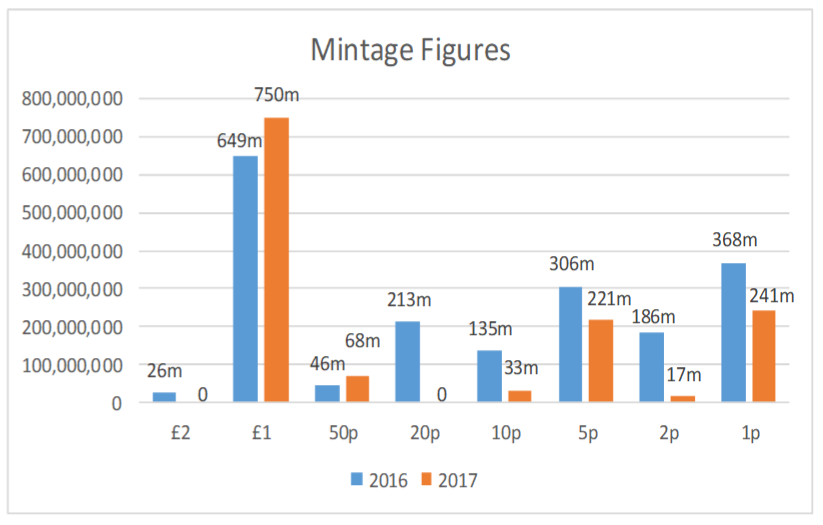

In 2016, nearly 29 million £2 coins and almost 213 million 20p coins were struck for circulation, however the next year that number dropped to 0.

From the graph above, you’ll notice that whilst most denominations had relatively few coins struck in 2017 compared to 2016, the mintage figure for £1 coins for both years is comparatively very high.

Introduction of the new £1

It’s thought that the introduction of the new 12 sided £1 coin to replace the old round pound in 2017 affected the demand for the other coins in circulation.

This could be down to the fact that the public were emptying their piggy banks and checking their loose change to make sure their old pound coins were used up before shops stopped accepting them. In doing so, they also ended up spending other coins in their change, meaning there was plenty of cash to re-circulate, and not as much demand for new coins to be struck for circulation.

This coupled with the growth of card payments and the decline of cash transactions, as well as the impressive 25-30 year lifespan of UK coins meant that enough £2 and 20p coins could be re-circulated in 2017 and new coins weren’t needed.

The Royal Mint had been expecting this drop in demand, as had been seen in similar cases overseas when coins were withdrawn.

Where does demand for cash come from?

The Royal Mint does not actually have any real control over how and when coins go into circulation, as this is based on demand.

HM Treasury and the large cash distribution services run by the Post Office and some banks, as well as private operators handle, sort and distribute the billions of coins in circulation, even swapping stocks between themselves.

The Royal Mint and cash distribution services regularly review the amount of coins in circulation and it’s only when they are short of a particular denomination that stocks will be called from The Royal Mint, who act as the manufacturer of the coin on behalf of the Treasury.

Surplus coins will be re-circulated before new coins are released.

Rare 50p coins from 2017

Whilst more 50p coins were struck in 2017 than 2016, two 2017 designs in particular actually have some of the lowest mintage figures of any 50p coins in circulation, excluding the Olympic 50p series.

The 2017 Royal Shield actually comes in as the second rarest 50p in circulation, closely followed by the 2017 Sir Isaac Newton 50p.

Take a look at our 50p and £2 mintage charts here.

Where can I find the 2017 £2 and 20p coins?

Whilst no £2 or 20p coins were issued for circulation in 2017, brilliant uncirculated commemorative coins were still issued, including the Jane Austen and First World War Aviation £2 coins.

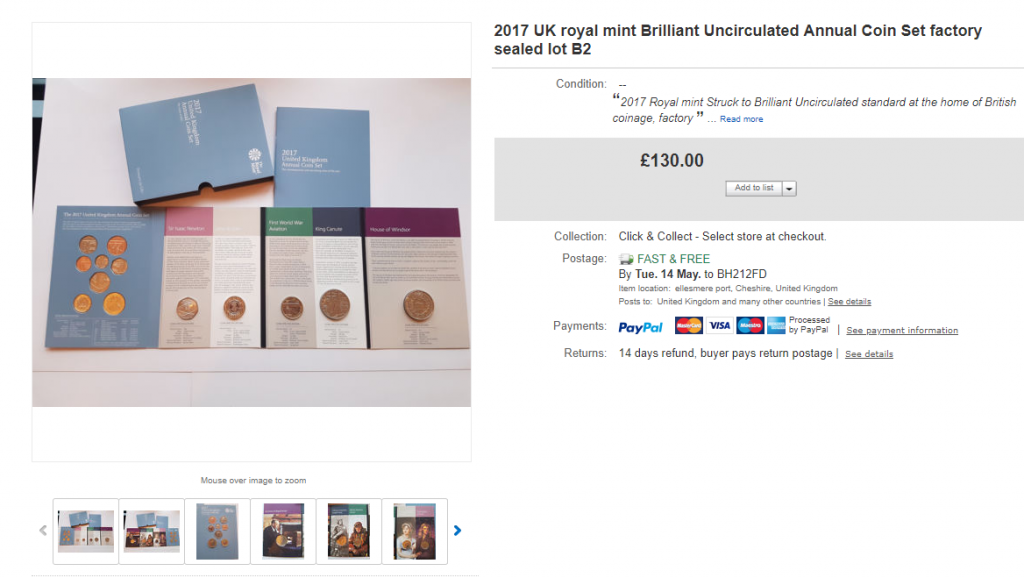

These coins, along with the 2017 Britannia £2 and the 2017 20p which weren’t issued for circulation were also featured in brilliant uncirculated quality within the 2017 Annual Coin Set, which has now sold out at The Royal Mint.

This means that the only way to get hold of these coins is to purchase the set on the secondary market, with prices typically around £65, although some sets have sold for over £100.

So far the 2018 £2 coins haven’t been released into circulation and whilst the 2019 Royal Shield 50p has been seen in circulation, we’re yet to hear if any of the other 2019 coins will turn up in our change.

Do you think the move towards a cashless society could be on the horizon, or are we still recovering from the surplus cash flow in 2017? Let us know in the comments below!

Secure the commemorative coins from 2017 for your collection!

Today you can own all 4 of the United Kingdom’s commemorative coins from 2017 with the Change Checker Commemorative Coin Pack, including the rare Sir Isaac Newton 50p and the Jane Austen and First World War Aviation £2 coins that can’t be found in circulation.

Time for change? What is the future for 1p and 2p coins?

*** UPDATE 25.07.24 ***

On 25th July 2024, it was announced that no new 1p and 2p pieces had been ordered from the Royal Mint this year. Despite this, the Treasury has denied that copper coins are to be phased out.

The lack of orders for 1p and 2p coins was due to there being enough of these denominations in circulation already. In fact, there’s an estimated 27 billion coins currently in circulation in the UK, all bearing Queen Elizabeth II’s portrait on the obverse.

A spokesperson for the Treasury said “We are confident there are enough coins in the system without the need to order more this year.”

It’s not unusual for there to be periods where none of these smaller denominations enter circulation. For example, no new 1p coins were put into circulation in 1972, 2018 or 2019, and there were several years in the early 70s and 80s where no new 2p coins were issued for circulation. More recently, no new 2ps have entered circulation since 2018, with the exception of 2021.

With no new copper coins going into circulation this year, that means that there still aren’t any 1p or 2p coins featuring King Charles III on the obverse in circulation. Currently, the only way to secure the new King Charles III 1p and 2p coins is in the New UK Coinage set.

Secure yours for just £32.50 (+p&p) >>

*** UPDATE 03.05.19 ***

This week, the UK Treasury confirmed that 1p and 2p coins will continue to be used “for years to come”.

A year after Chancellor Philip Hammond declared these lower denomination coins ‘obsolete’, their safety has now been secured.

There was much discussion regarding the future of 1p and 2p coins following the Treasury’s doubts over the validity of these coins, as well as the £50 note in the 2018 Spring Statement.

Now that the result of the review has been announced, what do you think about the decision and do you think the pennies should be dropped?

Following the 2018 Spring Statement, a spokesman for Theresa May said that there are no current plans to abolish the coins, however with the increased move towards digital payments, questions still remain as to whether it makes economic sense to continue producing these less frequently used coins and notes.

The Treasury consultation document revealed that The Royal Mint is currently issuing more than 500m 1p and 2p coins each year in order to replace those falling out of circulation.

In fact, six in ten UK 1p and 2p coins are only used once before being saved in a jar or thrown away!

Countries such as Canada, Australia, Brazil and Sweden have already scrapped lower denomination coins that are not in demand and it seems that the UK is also beginning to question the future of these coins as demand continues to fall. But how would you feel about removing 1p and 2p coins from circulation?

Only 15% of consumer spending in 2015 was accounted for by cash, with more and more people now turning to contactless and other digital payments – a trend which is forecast to become the most popular payment method in 2018.

On the other hand, the Treasury also suggested that cash is not obsolete. It’s estimated that 2.7 million people in the UK rely on cash and “It continues to play an important part in the lives of many people and businesses in the UK, whether as a budgeting tool or as a cheap and convenient method of payment”.

With regards to the £50 note, the Treasury says, “There is also a perception among some that £50 notes are used for money laundering, hidden economy activity, and tax evasion”. Despite rarely being used for “routine purchases”, there is still a demand for the £50 note overseas, alongside euros and dollars.

In our 2016 blog post, we asked Change Checkers if they thought it was time to scrap the penny and 53% of you believed we shouldn’t, as it’s part of the British culture.

Has your view now changed and do you think we should make a move towards digital rather than cash payments?

Chris Boyce said, “We have had pennies since 785 AD. I believe it’s one of the oldest coins still being used today. English heritage is being lost everyday…don’t let us loose the penny, 1233 years of history”.

If you’re interested in coin collecting, our Change Checker web app is completely free to use and allows users to:

– Find and identify the coins in their pocket

– Collect and track the coins they have

– Swap their spare coins with other Change Checkers

Sign up today at: www.changechecker.org/app